It can be intimidating to learn how to handle your finances when you are just starting out. This post will give you simple tips to take control of your finances.

Establish priorities and goals

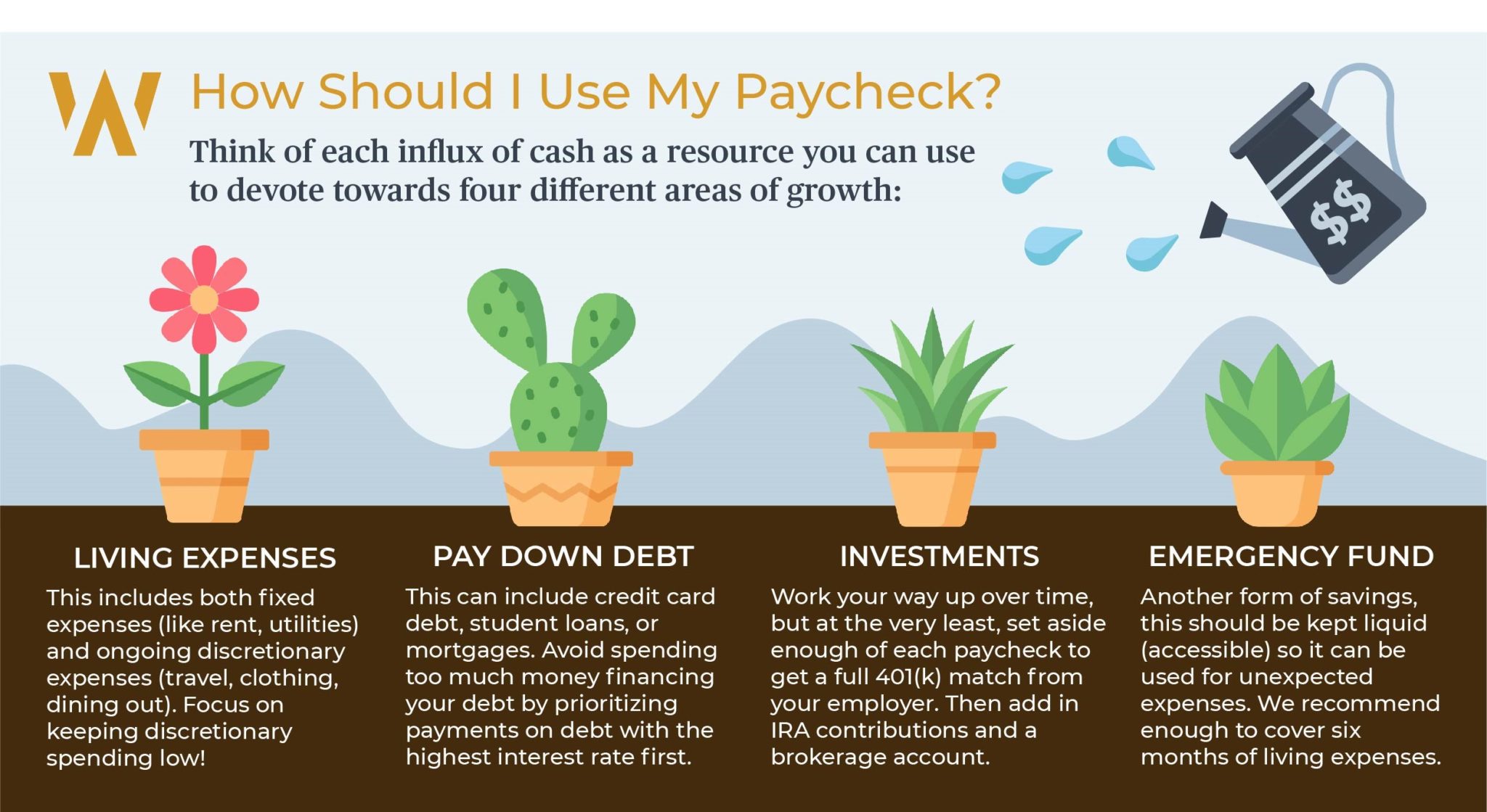

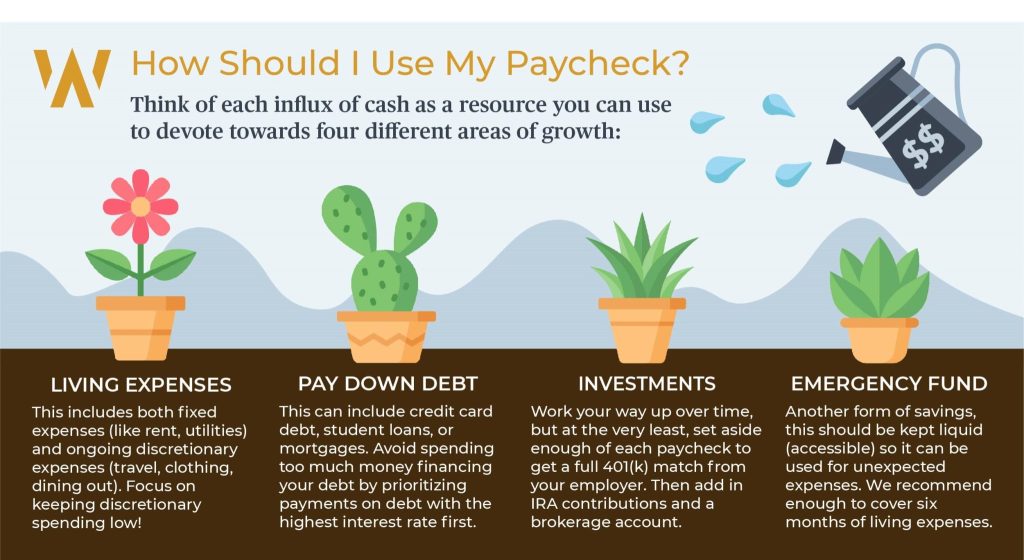

It is tempting to use your entire first paycheque right away. But what can you do with this limited amount of money?

Savings strategies that you can use to save money regularly:

- Directly automatic A portion of each paycheck can be deposited into a separate account. It is easier to save money if the money doesn’t appear in your sight.

- This money can be used to build an emergency fund, pay off debts, or add to your investments.

- Instead of a fixed amount, allocate a certain percent from each paycheck. The contribution amount will increase when your salary increases.

- There are many apps and platforms that can help you to save more often and smarter. You can achieve your goals by using these apps.

- Create an emergency fund . As a rule, it is best to always have Set aside 6 months’ worth of expenses.

- You can still earn interest on your emergency fund while it is safely stored in a money market account or a CD with no penalty. liquid is an important concept here. Depending on your savings goals, you might want to store certain funds where they can be accessed quickly without penalties.

# 2: Create & monitor a budget

A budget helps to keep you on track in terms of saving and monitoring your expenditures. We recommend that you focus on these areas when creating a budget:

- Calculate the monthly Take home pay after taxes and retirement. You may have multiple sources of income or irregular payments (bonuses, commissions, etc.). You should take this into consideration.

- After you know your monthly top-line income, make a list of all your Fixed Expenses. These are the expenses that remain the same every month, such as car insurance, rent or utilities, payments for student loans, cell phone plans, car payments, etc.

- Estimate your monthly discretionary expenditures. These are the costs that change from month to month (e.g. groceries, dining out, gasoline, travel, entertainment and clothes).

- Add your fixed expenses and your discretionary costs to your monthly take-home pay. You will know how much money you are left with at the end (or if you overspend) the month.

We recommend that you go through all of your previous credit/debit cards statements to total up the different types of expenses.

It’s great to create a budget, but it’s not very useful if you do not monitor each of your monthly expenses. You can pinpoint where you need to improve and find ways to save money. You can save money by using public transport instead of an Uber or buying your groceries rather than eating out often.

Many of these tools and platforms are easy to use and free. Excel allows you to create your spreadsheet. You will become more aware of your spending and find more innovative ways to save.

Master Debt & Credit Management

Cash flow management is even more crucial for young people who are often burdened with debt. Consider the costs of debt when deciding how to spend your money. Also, take into account the market conditions.

Understand the idea of an opportunity cost. Money spent on one thing has to be paid for by not using it elsewhere.

If your student loan is at 7% and the market is returning 5% and you have a mortgage that is fixed at 3% then it would be best to pay off the student loans first and invest in the market later, since the return is likely to exceed the cost of the mortgage.

The Next Steps and Advanced Planning Considerations

- Employer retirement programs. We encourage as much participation as possible in retirement and 401(k), since they can be powerful, tax-deferred saving vehicles. They may also include attractive matching programs from the company. There is such a concept as an over-allocation if you find yourself in a situation where you are forced to borrow from your plan.

- Insurance. It can be confusing to analyze insurance options by yourself, and many people are distrustful of insurance companies. Insurance is essential in certain situations, especially for families with young children. Group benefits are offered by many employers and can be an excellent place to begin.

- Estate Planning. Not only the rich can benefit from estate planning. Understanding your rights and assets when you die or become disabled is important.

What We Do with Someone Just Starting out

As a young person, developing strong financial abilities can start a cascade of events. You can reduce your debt quicker and save more for investment if you are disciplined in managing your finances. When you’ve saved enough to invest, you should consider which method is best for you. In recent years, the industry has seen major technological advancements that have made low-cost digital solutions more available than ever. Wealthspire Pathways is an offer of this type that allows us to deliver our core services at a low cost to tech-savvy and planning-focused clients.

The earlier you start saving and investing, regardless of which path you take, the greater the potential for growth. These principles should help you build a future that is based on knowledge, good financial habits and your confidence to manage your wealth.