You’ve decided to purchase life insurance. Before you buy life insurance, you must determine the amount of life insurance that you require as well as how long you wish to be covered.

It is important to invest in life insurance so that your family will be protected if you die. Americans often rely on crowd-funding to pay for funeral expenses. Financial relief can be provided by life insurance. Life insurance pays for more than funeral costs, even though this is why most people purchase it. It helps to protect the financial future of your family. You can select a range of benefits ranging from $100,000 up to more than a million dollars. Your life insurance rate will increase if you select a higher death benefit.

This article will explain the reasons why people buy life insurance

–Funeral costs

Transfer of wealth

– Repay a mortgage

Additional retirement income

– Charitable gift

You can pay for your children’s education

– Replace loss income

How can you decide how much insurance to buy for your family without paying too much? Here are some factors you should consider. Your adviser will be able to provide more specific advice, but there are also general considerations. Remember that the final decision on how much life insurance to purchase will depend largely on your goals, budget and family.

Choose Your Terms

How long until retirement? It is the easiest way to calculate how much life insurance you will need. This simple solution was chosen because people assume that you will no longer be financially dependent on others once you retire.

What is the amount of life insurance you need?

A simple way to calculate it is by multiplying your annual salary by the number of years left until retirement. If you earn $100,000 per year and have 25 years until retirement, then you will need to save $2.5 million.

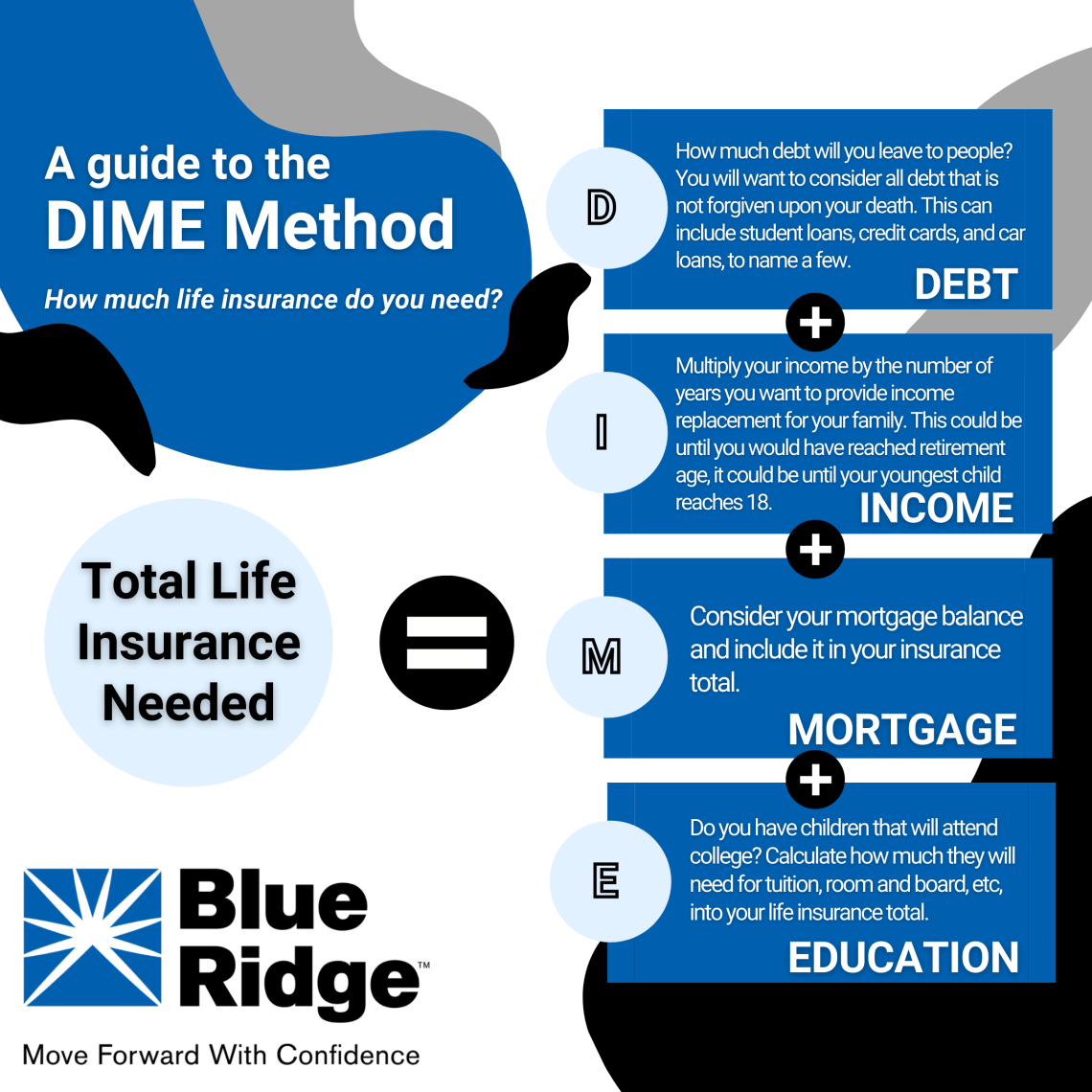

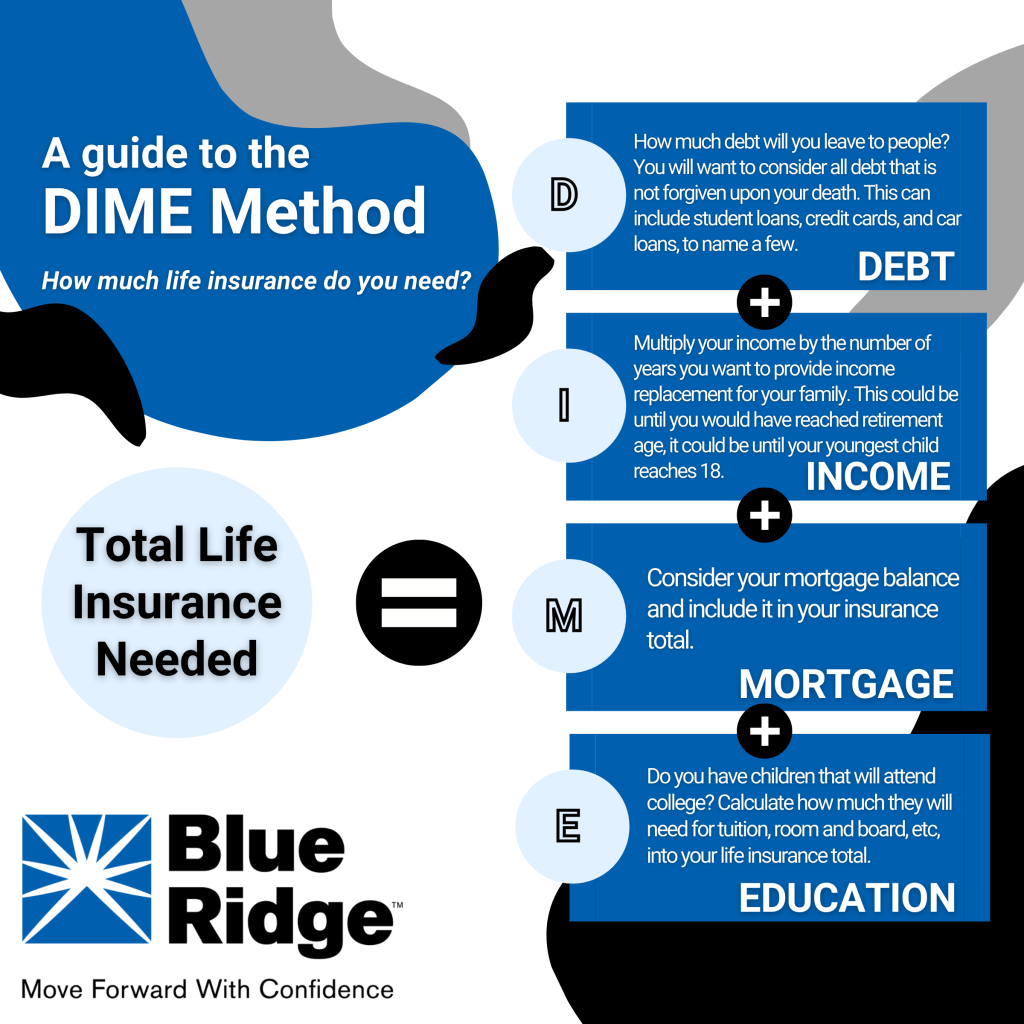

It is popular for calculating how much insurance coverage you require. The DIME Method takes into account some lifestyle aspects.

DIME Method

It is pretty common to use this method when determining the amount of insurance that you need. DIME is an acronym for debt, income mortgage and education.

Debt:

Your debt does not die along with you. What amount of debt are you leaving behind? Consider all the debts that will not be forgiven at your death. You can think of student loans, car loans and credit card debt.

Income:

You can multiply your annual income by how many years you wish to replace your family’s income. You could wait until retirement or until the youngest child turns 18. This is a decision you will want to make with family members.

There are other ways of calculating income.

Multiplying your income annually by 6 to 10

How many years are left until you retire? The simple way to calculate how much insurance you will need is by multiplying your salary per year times the remaining number of working years. If you’re 36 and earn $50,000 per year, but plan to retire when you reach 65, then you should purchase life insurance worth $1.4M.

Mortgage:

Include your mortgage balance in the total amount of your insurance.

Education:

Are you planning to send your children to college? Add the amount they’ll need to cover tuition, room, and board etc. into your total life insurance.

Other scenarios and factors are also important to take into consideration, but DIME Method is a great place to start.

Use our calculator to determine how much life insurance you might need.

The Standard of Living

What amount of money would your family require to live as it does now?

Examine your annual expenses to determine what your standard of life is. Take multiple holidays a year? Do you belong to a country club? Donations to charities? Multiply that figure by 20.

Your family will be able to maintain their income level for many years even after your death by calculating your standard of life and taking it into consideration.

Goals for Family

Consider your future family goals. Are your kids interested in going to college? What is your budget for weddings? Did your partner plan to go back to college? Understanding your long-term family goals will help you to build an insurance plan that is tailored for your needs.

Deductions from life insurance:

Additional life insurance. You may have an existing policy, or one that is provided by your employer. Consider removing the amount of your life insurance from that total. You should be cautious when considering your life insurance at work. If you lose your job or are fired, this money will disappear.

Saves:Your life insurance can be reduced by any savings you may have, if they are significant and valuable to your family.

– Funeral costs: You can subtract the cost of your burial insurance from total life insurance.

Plan de Savings 529:If your 529 is for the tuition of your child, you may also be able to subtract this amount from your total life insurance.

You can choose the best policy to protect you and your loved ones in years to come by carefully considering the options and consulting a trusted advisor.