Investors have had a difficult year in 2022. This type of decline in the equity market is common, but what occurred in the bond markets was unusual. When markets experience volatility or in times such as these, it is natural to feel the urge to do something. However, we’ve seen that acting when the market is at its worst is not always the best way to meet long-term goals. Here are four good reasons to stay invested in the long term.

1. Over extended periods, it is nearly impossible to predict the market.

You would need to 1) identify an event, 2) call the timing, 3) call the result, 4) call market reaction, 5) and finally, 6) determine how long it takes for it develop. To avoid a market crash, you would have to identify the event and then call out the timing and the outcome. You’d also need to call out the market reaction and the size of that reaction. It is relatively easy to identify market timing events, but it’s almost impossible to predict all six variables.

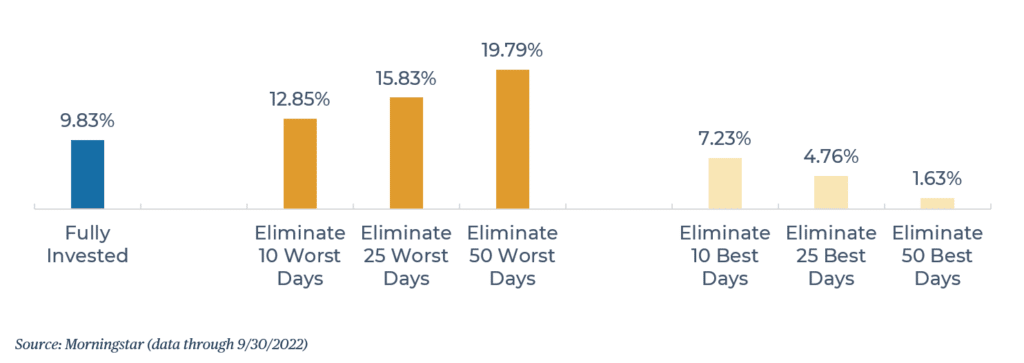

The best and the worst market days tend to be close together. Eight of the ten worst days between January 1990 and 2022 occurred two weeks after the ten best days. The chart shows that removing the 10 best days will reduce portfolio performance to below the level of a portfolio fully invested over the same time period.

Moreover, market cycles are different, and you cannot predict market changes, even if it appears easy in retrospect. Market reactions can be triggered by many things, including political situations, changes in monetary policy, or sudden shocks from abroad (such as a pandemic). Your returns can suffer if you don’t have the perfect timing.

2. Waiting to invest is more expensive than the returns.

We often get asked, “Why should I invest when I already know that there will be a recession on the horizon?” We respond:

- Nobody can predict with certainty when and how the market will drop.

- You would not be much more successful if you were able to predict the exact bottom. It is possible that the stress involved in trying to anticipate variables may not be worth it.

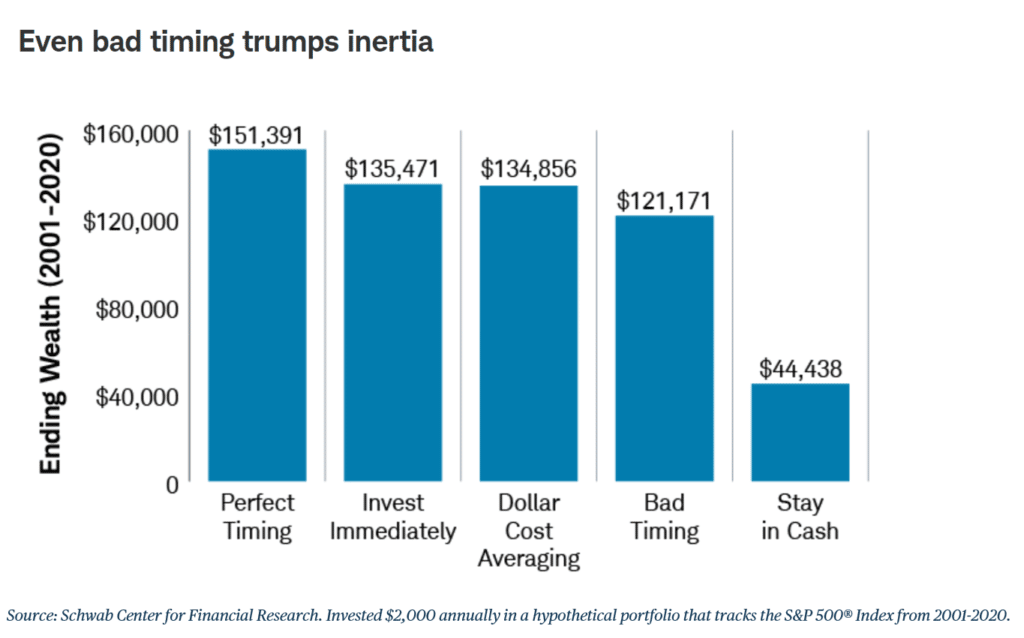

Five different strategies of investing were evaluated in a study. These ranged from the perfect timing strategy to cashing out. The perfect timing was the most successful, but it didn’t outperform investing instantly, using dollar cost averaging or buying at the lowest price each time. It may surprise some people to learn that investing at the bottom of the market is worse than poor timing.

3. A seller who sells during a market correction bets against the history.

In the past, periods of decline like those we’ve seen since 2022 were often followed by better returns in subsequent three-year and five-year time horizons.

When markets are volatile, reducing your exposure to equity can result in significant losses. You will also likely miss out on future gains.

Although periods of market downturns are difficult, it is important to contextualize them in relation to the past of the stock exchange.

S&P 500 had 17 bear market periods between 1926-2021. These periods lasted on average 10 months and saw a minimum 20% drop from the previous high. In the same period of time, S&P 500 saw 18 bull markets lasting on average 55 month and a minimum 20% gain.

4. A diversified portfolio has a very low chance of generating negative long-term returns.

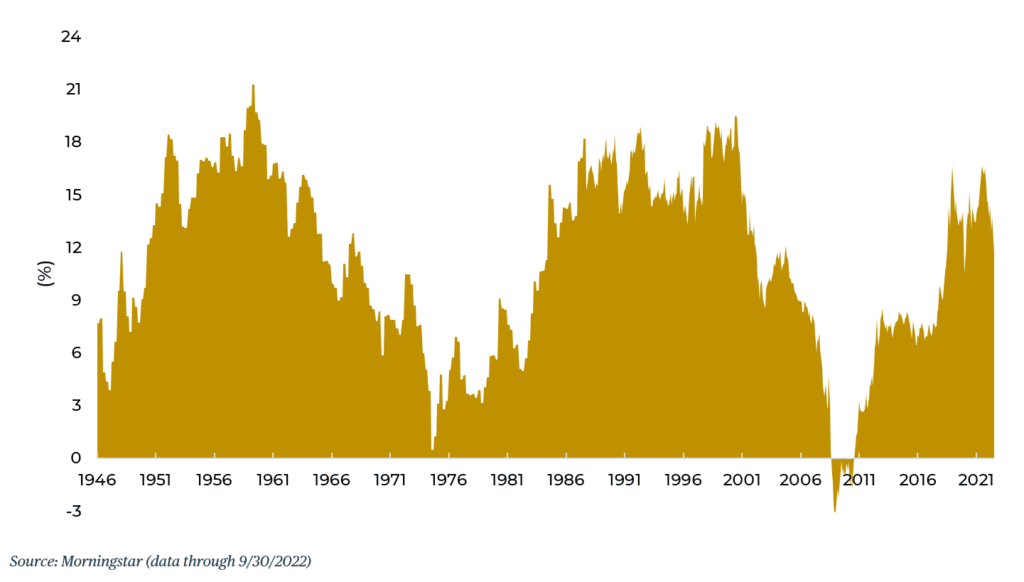

Since the end of 1970s, a portfolio balanced with global stocks and bond has never produced a loss over a rolling 5-year period.

Looking at S&P500 10-year rolling return data dating back to the year 1936, only one negative 10-year stock performance has been recorded. This does not mean that it can’t happen but rather, suggests the likelihood of such an outcome being rare.

What we can do is control what and when our next market downturn will be. We have no control over the timing or appearance of this event. We at Wealthspire Advisors believe a strategy-based allocation is the best way to achieve long-term success. We can’t predict the length of a challenging market cycle, but we do want to avoid drastic market rebalancing which would force us to sell at low levels or try to time a market that is unpredictable. It is sometimes best to do nothing, and stay fully invested in order to achieve your goals.