Since centuries, assets and liabilities have played a role in the world of finance. In the last two decades, there have been disagreements over what an asset actually is. This has all come about because of the book Rich Dad Poor dad by Robert Kiyosaki. Kiyosaki describes an asset in the book as “something that puts money into your pocket”. He means that only assets that pay you each month are considered assets. Robert’s definition is different from the one that most accountants, lawyers, bankers and businesspeople have been using for years. Kiyosaki agrees with this definition and says the house that you live in does not qualify as an asset, because it doesn’t bring money into your pocket. Is he correct, or are people being confused by him?

What Kiyosaki has to say about assets and liabilities

Robert’s Website:

“An asset is simply something that brings money into your pocket. “The simple definition of an asset is something that puts money in your pockets.” Many experts and accountants may have a different definition involving complex math, but it is true that anything that doesn’t put money in your pocket is not an asset.

Many things can be classified as assets. This includes things like real estate investment, a business or products such as books or artwork, or dividends on stock and bond investments.”

He claims that real estate which is rented is an asset, as it generates cash flow. However, the house that you live in is considered a liability since it doesn’t produce any cash flow.

This simple definition is very practical. Your home is a liability, because it drains your wallet each month with mortgage payments, taxes, insurance and maintenance expenses. It doesn’t put money in your pockets. only becomes an asset if it can be sold at a profit. When their homes were sold short, foreclosed or at a loss, many people affected by the Great Recession found that they had a liability.

What is an asset according to bankers, accountants and lawyers?

Traditional definitions of assets include:

“An asset is anything that provides a business with current or future economic benefit. Assets are everything that is owned and controlled by a business, whether it’s valuable now or will be in the future. Patents, machinery and investments are examples.

Liability is:

A liability is a debt owed by a company or person, typically a certain amount of money. Over time, liabilities are settled through the transfer of goods or services, money, and other economic benefits.

Kiyosaki’s real definitions, as you can see, are very different from the traditional definitions. According to accounting definitions, the house or real estate you live in is an asset. The loan secured against it is a liability. The house does not care if it makes or loses any money, or if its value goes up or down. It is an asset if it has value.

Why is Kiyosaki’s definition of an asset or liability confusing?

Robert claims that your house is not an asset, because it doesn’t bring you money. If you sold that house, and made money from it, then it would become an asset. The problem I have with this is that if you sell your house, how can it be an asset if you don’t own it anymore?

What is the value of the asset to the new owner? Was it a liability for you when you owned the asset, and then an asset once you no longer owned it?

He says that stocks, bonds and art are also assets since they pay dividends. (Art doesn’t pay dividends but he still counts it as an asset). He is also constantly pushing Bitcoin, gold, and silver. According to his definition, they are not assets because they don’t produce cash flow. It’s also confusing that his wife lists them as the five main asset classes on Robert’s website.

- Paper

- Businesses

- Commodities

- Cryptocurrencies

- Real Estate

She even claims that real estate which produces capital gains counts as an asset. They seem to have their stories mixed up.

Why is Rich Dad’s definition of an asset dangerous to you?

I am a real-estate investor, and also an influencer similar to Robert Kiyosaki. Many people comment on my blog, social media and videos. Conversations can be heated when I discuss assets versus liabilities. When I say that an asset is valuable, it doesn’t matter whether it makes money. People are angry. They then tell me that the house I live in is a bad one, and you should only purchase rentals.

It is a problem that most people’s home is their best investment. Statisticians show that 90% of wealth is created by the home people live in, even if they make less than $100,000 a year.

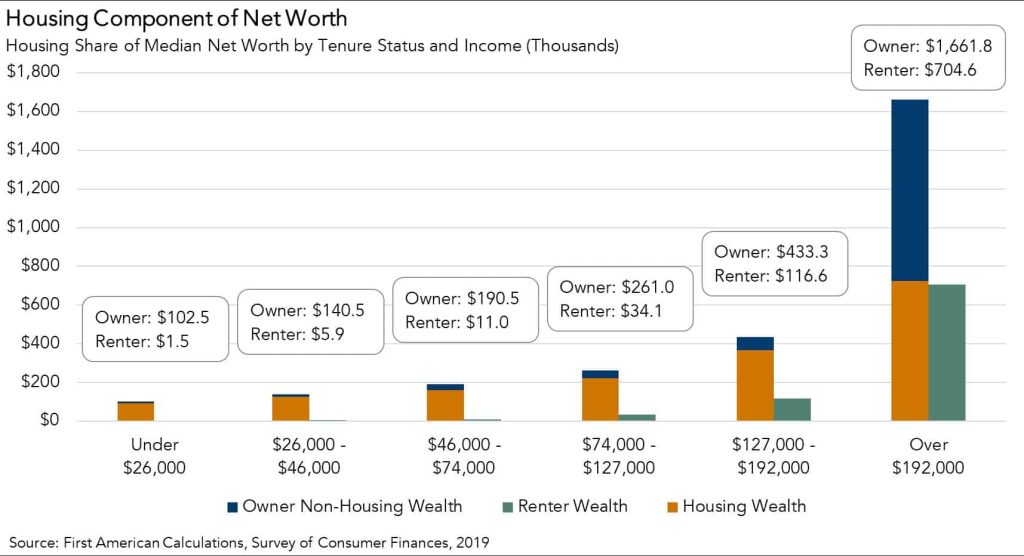

Owning or renting a house is the most important indicator of wealth for those with the lowest income. Renters have $1500 and homeowners have $102,500.

Robert’s definition of an asset, even though he does not state that buying a home to live in and never doing so is bad or wrong has led many to believe this. He claims that the traditional definition of an asset is confusing and involves complicated math. Robert’s definition is confusing, while the traditional one is simple. Particularly when his wife contradicts his views on his website.

I was able to purchase my first investment property with the money that I made from my personal homes. I was able to achieve my dream of owning 10 exotic cars , including two Lamborghinis. These are also assets. It’s so much easier just to call an asset asset. It is not necessary for an asset to be a great investment. In fact, it may even lose value. Depreciating assets are what cars are called.

“But Robert uses asset in a completely different way”

There are also people who say that there can be more than one definition of an asset. Robert’s definition of an asset is different from the accounting version. They claim that Robert does not mean the version in which an asset is something good or beneficial. “Carrie is a valuable asset to the team”. Why then does he claim that a home that people buy to live in is a smart investment and beneficial for them, but that the house itself is not an asset?

I will reiterate my point that buying the home you live in, is the best investment you can make if you’re not in the top income class. He would be wrong if he said that owning a home is not beneficial for most people. In the long term, owning a home is better than renting, and you will get more for your money. Investing can be good, but owning a home does not prevent you from .

Can a home put money in my pocket?

Robert’s main argument for saying that a house is not an asset but a liability is that it doesn’t put money in your pockets. Is it true that even if you accept Robert’s definition of an asset a house in which you live does not provide money for your pocket? I believe that renting is cheaper than buying and your house will put more money in your pockets.

He says that you have to pay for the mortgage, taxes, utilities and insurance as well as repairs. A house is expensive and most investments are costly, either when purchased or when maintained.

Rent is more expensive than a mortgage, and that is the difference between renting a house and buying one. Rent will continue to rise even if other expenses are higher than rent. Mortgages in the US, however, are usually fixed. Rent would be much more expensive than a mortgage over the same period of time. Rent after inflation adjustment will be higher and you’ll have nothing to show.

You can also get tax breaks from the mortgage owner if you do not itemize your taxes. The interest, property taxes and other expenses are all deductible. The value of the house is not mentioned. When people buy a home, they will often use a mortgage and put down less than the cost of the house. If the value of the home increases by 5-10%, then the return on could be as high as 1000%!

It is not a waste of money to repair or improve your home. The right improvements will increase the value of the house and its long-term worth. Equity is created over time by the appreciation of houses and the repayment of loans. This equity can be used for investing (this is exactly what I did), or to pay off other debts. Renters won’t have access to this equity, which is why they are so much poorer than homeowners. Even by Roberts’ definition, I believe that a home is an asset, because it puts money in your pockets.

This video explains the differences between renting and owning.

Is it true that buying a home to live in will make investing more difficult?

Robert’s critics will often say that it is best to buy a home to live in first and then invest in a rental. It is possible to save money by living in a cheap area and then invest the savings. If you have to pay rent to live, then it’s better to buy, even if your main objective is to invest.

One of the biggest obstacles to buying an investment property is obtaining a new loan. The debt-to income ratio is one of the most important factors that a lender considers. Rent or loan will be counted against your debt to income ratio, whether you buy or rent. Every loan application asks whether the borrower owns or rents their home. Banks are more willing to lend money to homeowners.

You can invest in another property if you buy a home to live in at a good price. This is what I did with my second home. After a year, I refinanced the house and I was able take out $50,000 to purchase my first rental property.

The conclusion of the article is:

Robert Kiyosaki’s definition of assets versus liabilities confused many people, causing them to not buy a home to live in. This was not Kiyosaki’s intention. To avoid confusion with accountants and banks, I believe it’s best to stick to the traditional definitions of assets and liabilities. I believe that even if Robert uses the same definition, buying a home to live in remains one of the best investments you can make. Statistics also support this.