Many people, including Jerome Powell, the Federal Reserve’s chairman, believe that high interest rates will reduce housing prices. Many people believe that higher interest rates will make housing less affordable, and thus prices will drop. This line of thought is flawed in many ways, but it misses an important concept. Prices may temporarily drop or even level off, but high rates will always lead to higher prices in the long run. Higher interest rates will make building houses more expensive. This will result in fewer developers and people being able to build. In the United States, we already have a huge shortage of housing which has led to a big increase in prices. Reduced building will only make the shortage worse, and increase prices in future.

Has high interest rates ever caused real estate prices to drop?

Powell included, many people believe that high rates cause prices to drop or level out. Powell quoted this in 2022.

Powell stated during a press conference that “housing is affected significantly by these higher interest rates which are back to where they were prior to the global financial crises.” The housing market was overheated in the years following the pandemic as rates were low and demand was high. The housing market must find a new balance between supply-and-demand.

He said that rates then were much lower than now, and that mortgage rates were higher before the global financial crises. The rates were higher in the 1980s and 1990s, but now people are used with very low rates.

historically, raising interest rates have never caused a drop in housing prices. Multiple studies show that high interest rates never cause prices to fall. In the 1970s and 1980s, interest rates were among the highest in history. The 70s saw the most rapid real estate appreciation in the past 100 years.

The high rates increase the cost of buying a home, but also decrease the stock because people don’t want to sell their homes and lose their current lower rate. Sales are often affected by high interest rates, but not the prices. Many things become more expensive when rates are high.

Here’s a video that I made two years ago about the impact of rising rates on the real estate market.

How does high interest rate make building a home more expensive?

In today’s highly regulated government environment, building houses is not an easy task. The building codes and development requirements are becoming more strict every minute. New construction costs will increase if you make building or development more difficult. But that’s another topic. This is why new construction costs more when rates are higher:

- Material Costs: Nearly every company sources its supplies from companies who use debt. As the cost to borrow increases, so do the costs of materials and therefore prices. Construction materials have also been a source of supply chain problems. When borrowing costs are so high, it is difficult to expand production and fix these issues.

- Increase in labor costs: When interest rates are high, the cost of labor can also rise. Workers will then demand higher wages in order to compensate for higher living costs. We constantly hear how inflation is a problem for the middle and lower classes. Raising wages to combat inflation can actually cause more inflation. Powell has repeatedly said that wage increases are a major cause of inflation.

- Cost of debt: The majority of people and home builders borrow money to build homes. If debt costs increase, the cost to build will also rise.

What are the effects of high interest rates on new construction?

High interest rates not only increase the price of new construction but also reduce the number of new buildings. As I said before, prices do not usually decrease when rates are high. However, sales do. Prices may not drop or may only do so for a brief period of time. However, sales are almost always affected by higher rates. The higher rates make it harder to sell homes, which is why builders are hesitant to build. The construction of a home can take up to a year. If builders are worried about the real estate market, they may not build or build as much.

As we have discussed, higher rates also mean higher construction costs. Builders will be hesitant to begin new construction if the cost of building increases. How can they know that the market will support higher prices if rates are higher? In the past, higher rates have supported higher prices but it is still a risk!

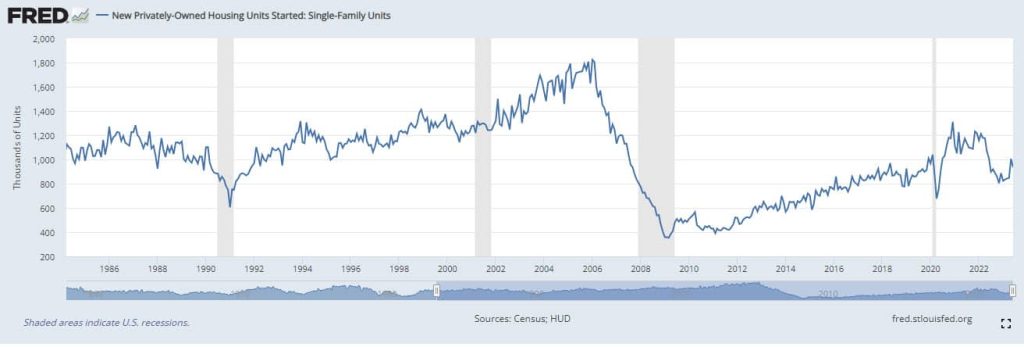

The graph below shows the start of single-family construction. After the Housing Crash, we saw record low construction for many years and were just beginning to return to normal when interest rate spiked. The huge drop in new construction in 2022 is evident. While it has risen a little, it still falls short of what it needs to do to meet demand.

single-family starts 2023

What is the impact of less new construction on prices?

Housing shortages are a problem in the USA and most other parts of the world. Governments keep making it more difficult to build and develop, and then they wonder why less is being built! A shortage of housing means that more people will be fighting for fewer homes, which increases the price. As the population continues to grow and move around the country in search of new housing, prices will rise.

Powell might have thought that higher rates would help make housing more affordable. However, I’m not sure if Powell considered the impact of higher rates over time. The rates will definitely decrease new construction, and increase the cost of building which will in turn lead to higher prices over time. The higher the rates, the more serious the problem becomes. Have you ever heard of the phrase “kicking the can to the side”? The reason they may not be willing to lower their rates is that a possible buying frenzy might occur, but the longer the wait, the worse the problem will become.

The conclusion of the article is:

In general, higher interest rates will likely have a negative effect on the construction sector. It will be more expensive to hire workers, borrow money and finance projects. We have already seen and can see a decline in new construction, which will worsen the inventory problem, making housing more expensive in future.