Real estate investors are often accused of causing homelessness through their rental properties and rent. However, they can have a positive impact on preventing homelessness, by implementing strategies that encourage affordable housing, stability and supportive services. Renting is the next step to homelessness for those who are in dire housing situations and cannot afford to buy. Here are key ways that real estate investors can help prevent homelessness.

Do landlords drive up real estate prices?

A growing trend is to say that landlords do not need to exist and that the world would be better without them. Many statements are made to support this stance, but they tend to be exaggerated and/or simply false. I am a landowner and I am biased, but I’ve been a real estate investor, agent, writer, and influencer for over 20 years. I’ve seen the real world, and I know a few things about real estate. Many opinions about real estate investors and landlords come from pages or politicians who have no experience in real estate.

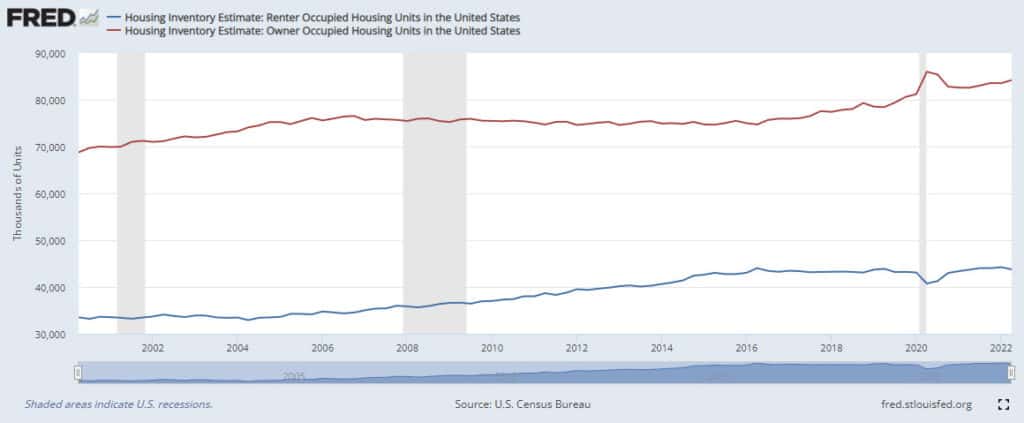

Because they buy all the houses, landlords don’t drive up prices. Owner-occupied rates have increased from 62 to 66 per cent between 2016 and 2023. In 2023, there will be 11 million more units that are owner-occupied than in 2016. The number of rental units will remain the same. In reality, real estate investors have been selling more than they’ve bought.

Rents are rising as fewer rental properties are available because landlords have sold. It’s just supply and demand. Rents are supposed to rise because landlords buy all the houses, but this is not true. The opposite happens when the supply of housing increases. Prices are mainly affected by the costs of construction, replacement and development.

What is the role of landlords?

Some people hypothesize, that if the landlords were removed (yes, some advocates violence), housing would become more affordable and therefore more people could purchase. This theory has a problem because not everyone wants or can buy. Some people are denied loans because they have poor credit or no work history. Some people want to travel, or don’t even want to own a home. This theory ignores them and assumes that they will magically become able to purchase a home because the prices will be lower without landlords.

The idea that there will be a lot of housing available for purchase is the basis for this theory. The housing is occupied by renters and occupants. Renters will keep the housing supply low unless they are evicted. Renters who are able to purchase the home they currently live in may do so, but a large influx of housing will not occur unless millions of renters are homeless. They also assume that everyone will be able to get a loan once the laws have been changed, eliminating all credit requirements and other loan restrictions. In 2008 , we saw the results of loosened loan guidelines.

Renting is the first step to becoming housed. Some might argue that more social housing was needed. Although I understand the argument, landlords do not stop more social housing being built. In fact, they are helping to create what social housing there is.

How do landlords prevent homelessness?

There are many programs in the United States that help those who need it, including Section 8 vouchers, grants for affordable housing, and tax incentives. Investors are the ones who build and run most social housing. The government is encouraging affordable housing projects to build and be redeveloped, but it’s not them who are doing the work. Real estate investors are the ones who create and build these properties. This is not a problem unique to the US. Austria is often cited as having a massive social housing program. Most of the social housing is owned by private investors. Section 8 vouchers can only be used for properties that are owned by private investors and not by the government.

House Flippers buy properties that are not livable and turn them into livable homes. This helps to reduce homelessness as well as increase the housing supply. After buying many vacant single-family homes and multi-family houses, I brought them up to living standards. Will I earn money if I do this? Hopefully! Investors will not undertake these projects and no one else will, resulting in fewer and more expensive homes due to the supply and demand principle.

Investors in real estate also build housing. Investors build single-family homes and apartments. These are then rented out? This does add inventory to the market, which gives buyers and renters more options. A more stable housing market is a result of increased inventory.

Should real estate investors have restrictions on what they are allowed to buy or build?

Many people, including those in the real-estate industry, believe that real estate investors need to be limited on what they are allowed to buy or build. The government also tries to limit investors’ ability to buy properties. These programs are mostly aimed at large institutional investors, but these are only a small part of the market. They hold less than 1 percent of the housing market.

There is a lack of rental properties on the market. Rents are increasing because of this.

More restrictions on investors are the best way to raise rents and housing prices. The countries with the highest prices also have the highest restrictions. Many institutional investors also build houses when we desperately require more housing! Some people are saying that this is bad, and it must be stopped.

The conclusion of the article is:

Real estate investors are essential to the housing market. Without them, there would be fewer homes, more homeless people, higher prices and a general disaster. More restrictions will discourage investors from creating affordable housing, and therefore create less affordable housing.